zendit offers an API platform tailored for Money Transfer Operators, enabling them to broaden their service range with instant, cost-effective transaction solutions.

Our platform allows operators to enhance their offerings with prepaid products such as Mobile Top Up, Digital Gift Cards, and Utility Payments, alongside traditional transfers. This expansion allows operators to offer more versatile and convenient services to their customers, catering to a broader range of payment needs and preferences, thereby improving customer satisfaction and loyalty.

This integration not only reduces transaction costs but also ensures safer, instant transfers of value, giving customers flexible options and peace of mind.

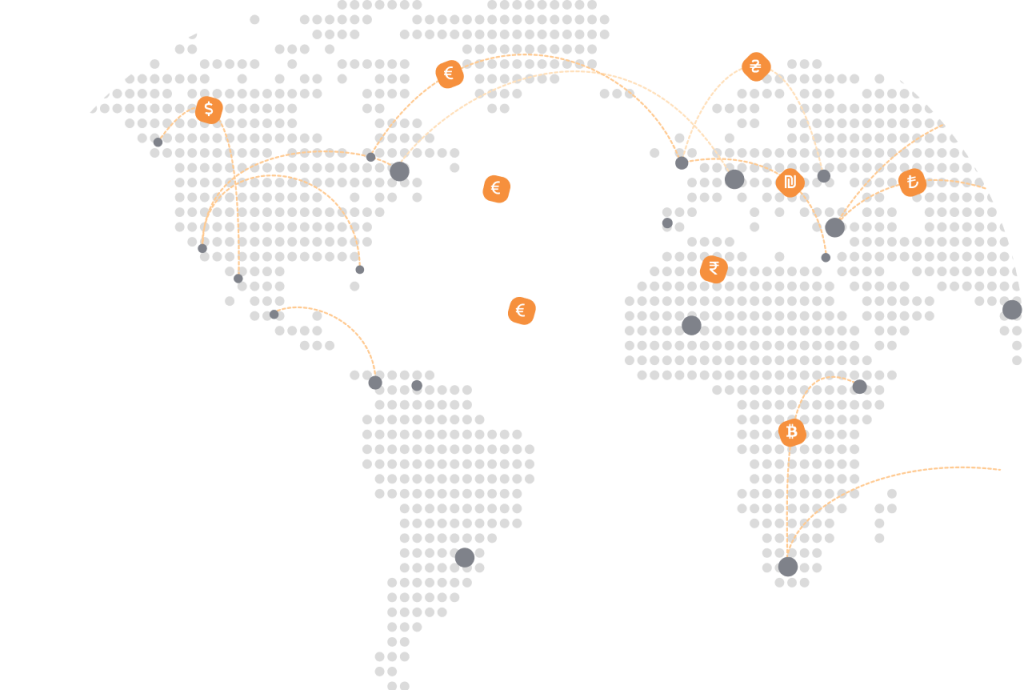

zendit’s platform aims to eliminate global borders in financial transactions, making international transfers seamless and efficient. By integrating our API, Money Transfer Operators can offer their customers a global reach with local ease, effectively connecting different regions with minimal barriers.

zendit platform offers flexible funding options, enabling Money Transfer Operators to provide their customers with a variety of ways to fund transactions, this flexibility enhancing user experience by accommodating different preferences.

We empower organizations to seamlessly integrate and monitor the status of their product-based transactions. It’s crucial to note that these transactions differ from traditional money transfers, allowing for a tailored and effective approach to tracking.

We empower integrators with the responsibility to oversee and supply transaction history for their customers. This client-centric approach ensures integrators have full control and can tailor the transaction history experience for their users, highlighting zendit’s commitment to delivering a flexible and personalized service.

zendit provides a secure and trusted environment for your business, while also maintaining transparency and accountability. While zendit equips our clients with the necessary tools, we provide support and security all the way.

zendit provides a framework while giving integrators control over recipient details. This approach ensures that integrators have control over the recipient details, allowing for a tailored and secure recipient management experience for their users.

Explore an updated and diverse product range.

Effortlessly handles large volumes of requests.

Personalize both appearance and functionality.

Designed for an intuitive and hassle-free experience.

Crafted for fintech and scalable startups.

State of the art protocols for secure transactions.

Personalize both appearance and functionality.

zendit presents many opportunities and features to our partners across the globe.

Source: World Bank

Source: Research and Markets

Source: ACI Worldwide

Source: Statista

Source: World Bank

Source: Federal Trade Commission

To get more detailed info on how zendit operates and collaborates with companies across the globe, check out our flyer.

DownloadExplore zendit effortlessly with our detailed guide for a seamless experience through our offerings.

Start selling with zendit.

Rest assured, we won’t flood your inbox. We’ll simply keep you informed about our progress, new features, and helpful support articles.

Check out our privacy policy for more details.